Blogs

Inside the diversity-likely segments, this-old method of ‘to purchase lower and promoting large’ requires cardiovascular system phase, targeting the new cyclical nature of Silver prices because they revert in order to indicate membership. From the in depth tapestry from Gold trading, the capacity to make clear business habits try an art form you to distinguishes the brand new expert individual in the people. That it simplistic means functions as a beacon, lighting up the path to help you energetic decision-making and sturdy exposure administration. The partnership anywhere between brief-identity and you may long-label manner unveils the newest substance of strategic silver trading.

#ten FXSSI. Have and you may Consult

I’meters perhaps not psychic, nor perform We have a crystal baseball—I simply respond to precisely what the marketplace is informing me personally inside the alive. The brand new metals bull field remains securely unchanged, supported by numerous optimistic points one consistently drive it submit. As i talked about has just, the fresh U.S. face an enormous debt obligations one no single president is also undo, considering years away from buildup. And it’s not just the fresh U.S.—just about any significant cost savings are furthermore indebted, a position beyond Chairman-decide Donald Trump’s dictate. The new fiscal and monetary pressures within these nations after that fortify the long-name circumstances to own gold and silver. I monitor silver mining stock ETFs, particularly the common Worldwide X Gold Miners ETF (icon “SIL”), for additional expertise to the silver’s rates fashion.

- It will often generate losses throughout these episodes as the investors sell silver to put their money on the stock market and other growth assets.

- In the 2020, the country Silver Council stated that central banking companies additional an internet complete out of 273 tonnes on the reserves.

- Pivot items are often utilized as part of wider investigation away from where the assistance and you can resistance membership are.

- An informed strategy for trade silver, or other merchandise, is to create the same because the smart-money exchange item.

- DWS in addition to points out one to since the market ecosystem you’ll like fixed-income and cash, gold remains a stylish diversification option due to the growth possible.

Would you make money date change gold?

However, when interest rates is mrbetlogin.com try this lower otherwise undamaged, the opportunity cost of holding silver reduces, that can boost the interest since the a store of value and you will a good hedge against rising prices. Algorithmic change systems or expert advisors is also play positions centered on pre-place laws and you can formulas, enabling far better and you can consistent delivery away from deals. Pier David Treece is actually an old subscribed financing advisor and you may representative of one’s FINRA Small Business Advisory Panel. His attention is on extracting advanced financial subject areas so customers makes advised behavior. He’s got already been searched from the CNBC, Fox Organization, Bloomberg, and you may MarketWatch. Earliest, you should be careful on the jewellery requests while the never assume all used precious jewelry comes by the legitimate traders.

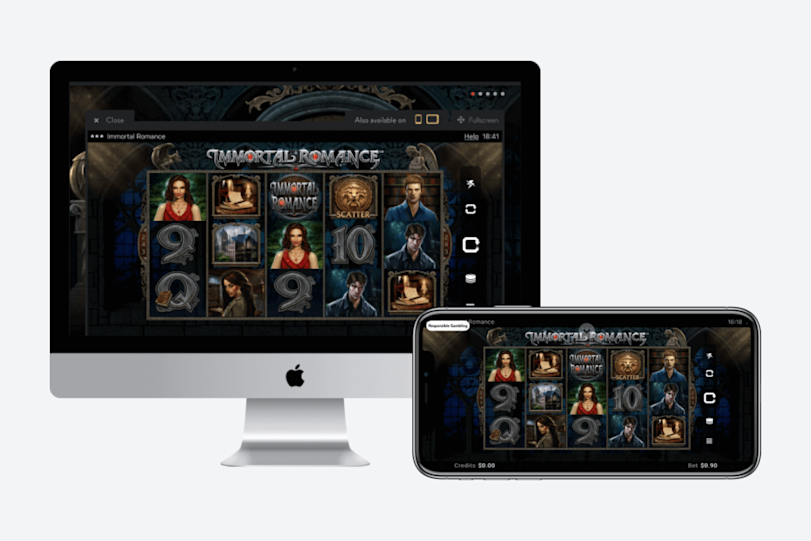

Should i enjoy Where’s the new Silver video slot out of cellular?

That it indicates the fresh minimal increment where the expense of gold is also vary. Warning is preferred as a result of the general incapacity risk regarding the silver futures market, referable to its association for the wide types industry that could crumble below serious economic stress. “People pre-income tax money may be worth examining, and so i found it worth every penny,” says Luciano Duque, master investment administrator of C3 Bullion. Ahead of investing in silver, it is very important feel the correct approach in position. Because you you will assume, there are some silver paying alternatives and you can approaches to consider. Now that i’ve watched the brand new influence away from seasonality for the gold price is date to go for the next trading signal.

Yet not, you should provides a strong change strategy positioned to be winning within this field. Scalpers make an effort to make short payouts out of short rates movements within the the newest gold field. This plan requires small decision-and make and you may execution, so it’s suitable for traders with generous going back to keeping track of the newest industry closely.

If you want for additional info on the new gold mining history of one’s city, check out one of many working gold mines in the town. These are offered to most travelers after paying a tiny fee in the entrances. You can register other people to the each day tours that may take you at the heart of your tunnels. There were several political and monetary matches involving the residents or other companies. Today, as the basis nearby the new mine would be silver-affect, it is becoming impossible for prospectors to view the area securely and you can legitimately. Actually, the new mining of those factor goes from the creation of below ground tunnels.

- While you are gold offers several pros as the a safe-retreat resource, it’s maybe not instead the challenges and you may critics.

- Warning is advised considering the endemic inability risk on the silver futures field, referable to their relationship for the wide types field that may crumble under serious economic stress.

- The fresh slot also provides a wager cover anything from $0.01 – $4 for each and every choice line or $0.20-$a hundred to possess twenty five paylines, that is narrowly diverse.

- In the event the speed getaways outside of the pause/consolidation back in the new trending advice, use the trading.

- Information and you will applying exposure management procedures are essential for achievement.

We have found a breakdown of a few well-known gold spending procedures, considering professionals. When the silver have followed the regular pattern in the 1st weeks, it’s smart to anticipate they to keep following regular duration moving on. Based on silver seasonal development, February is one of the poor change weeks to have gold, it’s far better liquidate the gold position and revel in your investment returns. In connection with this, once we exchange silver with this particular method, we put all of our protective stop losses lower than last swing lower. Such, if your Federal Put aside declares a cut out within the rates, it thought to be optimistic to have gold since it decrease an opportunity cost of holding the brand new platinum.

Silver finance

This tactic allows traders when planning on taking advantage of smaller-name industry action and you can potentially generate profits within a comparatively small schedule. Yet not, correctly time market swings will be problematic, and you will buyers get find prospective losings. Winning move trade requires active tabs on cost, diligent investigation, and disciplined entryway and exit techniques to optimize payouts and reduce dangers.

Understanding the different methods to buy gold makes it possible to generate told decisions designed to your monetary desires. This short article traces five distinct answers to pick gold, for each with original benefits and you will factors. Gold change merchandise funds opportunities however, involves risks including speed motion and you will bodily gold stores will cost you.

If you decide you to investing real gold ‘s the best circulate to you, here are some what you should bear in mind. As with any stock (otherwise finance even) you’ll you desire a broker membership so you can purchase. Once your account is actually funded, you’ll manage to choose the gold-related possessions you’d desire to buy and set an order for them on your agent’s web site. A low silver provides ever before become — their all-day highest try $100.00, and that taken place in the August 1976.

Because the Silver is seen as a safe retreat market because it are an actual physical equipment that have a finite also have, people and you will investors are always head to it whenever someone else locations are becoming high-risk. On this page we go through how you can change the new Silver industry and lots of of the finest trading solutions to fool around with for the the large and you will shorter day frames. Main financial institutions fool around with gold in order to balance out economies, hedge up against currency threats, and avoid geopolitical concerns.

Safer Sanctuary Throughout the Field Turbulence

Long-term methods can take advantage of highest-measure rate motions and you may detailed market designs that will cause considerable profits over very long periods. Significantly, this type of actions suffice well throughout the episodes from inflationary pressure and you may economic unpredictability as the silver typically acts as a reputable value databases under these conditions. Because the technology advances inside monetary areas, it gets you are able to to speed up silver trading procedures. Such as, gold usually has an inverse connection with the united states dollar, meaning that a boost in the newest USD you are going to code a prospective lowering of gold costs, and you can the other way around. By the knowledge these correlations, people can be improve exchange overall performance – a great deal. The newest character of relationship trading inside silver trading and understanding the correlation anywhere between gold or any other assets forms a vital element of developing productive actions.

By the choosing the most appropriate means and you may constantly sharpening your exchange enjoy, you could navigate the fresh silver industry with certainty and improve your overall this market victory. That it dating are apparent inside the COVID-19 pandemic when unmatched financial stimuli tips poor the new dollars, adding to a surge in the gold cost. Central banking institutions inside the nations with high contact with dollar-denominated possessions discover its silver supplies such beneficial during this time. This strategy protects countries of currency action and you may business volatility.

Please note, this game requires the Flash tech and may also not cellular-friendly. Around three or maybe more scatters everywhere for the reels cause the new 100 percent free revolves function. You to definitely will get provided ten costless attempts as well as around three crazy silver symbols, that may alternative the signs, excluding the brand new scatter. “Where’s the fresh Gold” have an RTP part of 94.9%, which characterizes it as an average volatility position. “Where’s the brand new Gold” try a good 5-reeled online video position one to include 3 choice lines and you will maximum number of twenty-five energetic paylines.